Opening LC is one of the indispensable steps in the import and export process. So what is LC? What conditions are required to open the LC? In this article, DNC will help you get the most accurate answer.

What is LC?

LC (letter of credit) or letter of credit. A letter made by a bank at the request of the importer. To commit to paying a certain amount of money at a specific time to the exporter (beneficiary). In case this exporter presents to the bank a set of payment documents in accordance with the terms and conditions stated in the letter of credit.

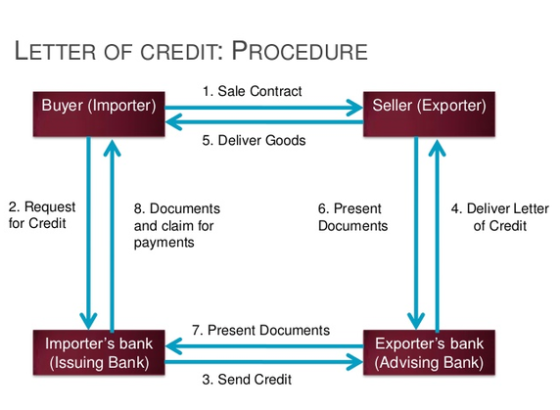

The Letter of Credit Process

There are typically seven steps that occur in order to get paid using a letter of credit:

- The importer arranges for the issuing bank to open an LC in favor of the exporter.

- The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter.

- The exporter forwards the goods and documents to a freight forwarder.

- The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

- The nominated bank checks documents for compliance with the LC and collects payments from the issuing bank for the exporter.

- The importer’s account at the issuing bank is debited.

- The issuing bank releases documents to the importer to claim the goods from the carrier and to clear them at customs.

Relationship between LC and foreign trade contract

A foreign trade contract is a basis for creating LC. However, once the LC has been released, it will be completely independent of the foreign trade contract.

Specifically after signing a foreign trade contract. The buyer is based on the contents and agreements agreed in the contract to the bank (importing country). The bank will require a signed letter of credit to commit the payment to the exporter.

After the LC has been issued, if the exporter agrees and accepts its contents. Following this, the exporter will have to fulfill the obligations set forth in the LC.

Conditions to open LC

If the importer wants to ask the bank to open the LC, it is mandatory to fully meet the following conditions:

- Capital sources for LC payment assurance:

In the contract of terms of payment by LC, customers need to stipulate and carefully consider the capital to pay for their LC and ask the Incombank to open:

- LC issued by own capital, customers must deposit 100%.

- LC issued by own capital, customers do not deposit 100% and / or require exemption or reduction of deposit. At this point, the customer will have to contact the credit evaluation research review and have the director or his or her authorized director approved.

- LC issued by the loan from Incombank, customers contact the appraisal credit department to be considered.

- Request to open LC:

You must complete the LC opening request form. Note: LC is opened by the bank at the request of the importer. Therefore, you need to carefully review the content of the contract to make sure when it is put into the LC without conflict.

Application for opening LC includes:

- Application for LC opening.

- The decision on establishing the business (for enterprises conducting transactions for the first time).

- Business registration certificate (for enterprises conducting transactions for the first time).

- Registration of import-export codes – if any (for enterprises conducting transactions for the first time).

- The original foreign trade contract (if signing a contract via FAX, it must be signed and sealed on the copy).

- Entrusted import contract (if any).

- Import permit of the Ministry of Trade (in case the imported goods are on the list of management specified in the Prime Minister’s Decision on Import and Export Management annually).

- Payment commitment, credit contract (in case of a loan), the written approval for the opening of deferred payment LC of Incombank (in case of opening LC with deferred payment).

- Foreign currency trading contract (if any).

- The LC opening statement prepared by the branch’s credit bureau and approved by the branch director or an authorized director (in case the deposit is less than 100% of the LC value).

The above papers must be submitted with a stamped copy of the enterprise and present the original. As for the following documents, the original must be submitted:

- Payment commitments.

- Loan agreements.

- Foreign currency trading contract.

- Client’s LC application.

- LC opening statement.